State of Solana: Real-world Assets

The article provides a detailed overview of Solana’s latest developments across four key Real-World Asset (RWA) categories—yield-bearing assets, tokenized public equities, non-yielding assets, and infrastructure providers—and illustrates through concrete examples how Solana is attracting both institutional and retail participants to on-chain RWA trading.Key Insights

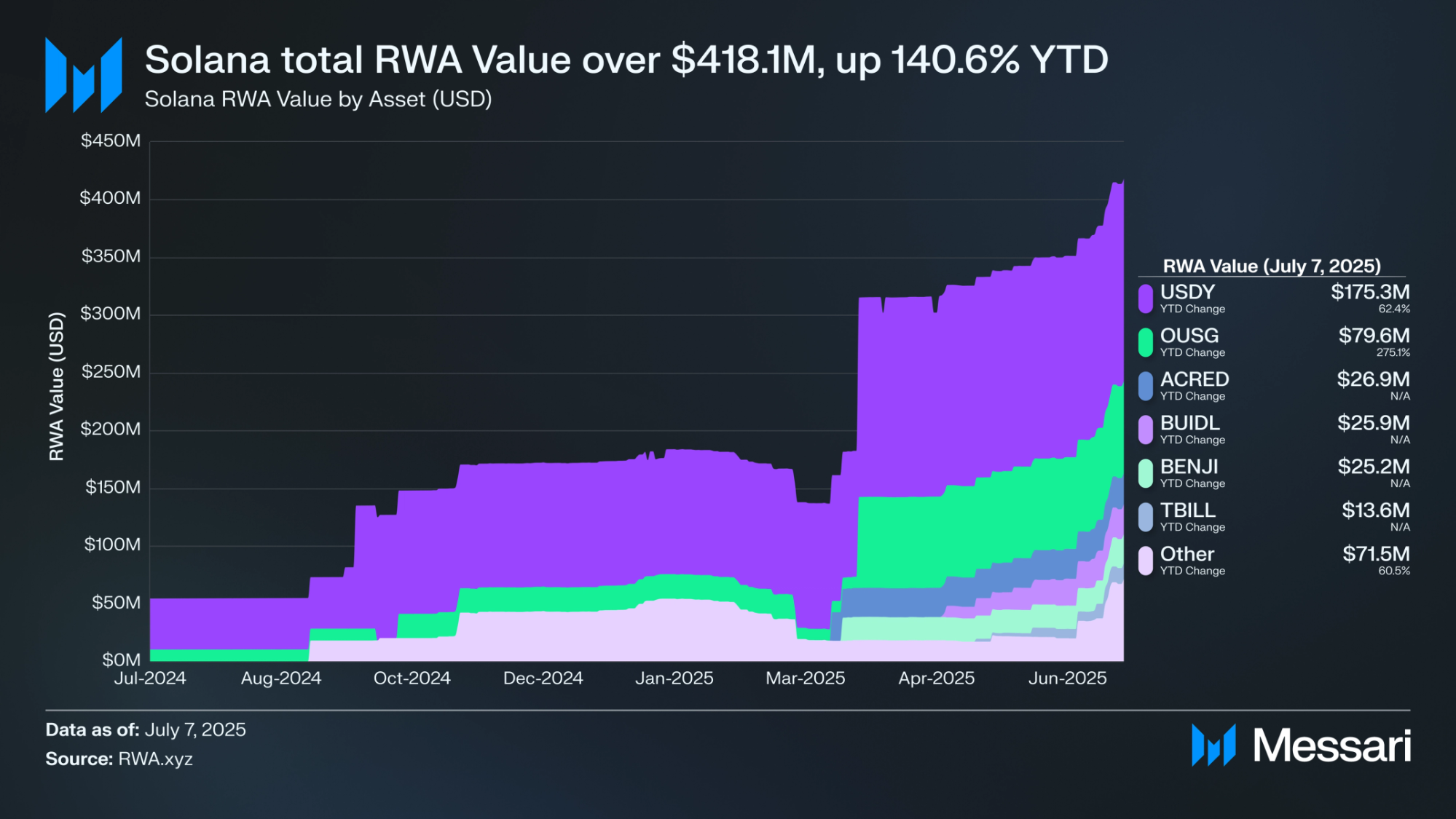

- Real-world assets (RWAs) on Solana are valued at over $418.1 million, up 140.6% YTD. Ondo’s USDY leads the category with $175.3 million, a 41.9% market share, followed by other assets like OUSG, ACRED, and BUIDL.

- Backed brought tokenized equities to Solana, in partnership with Kraken, with xStocks on June 30, 2025, allowing over 40,000 wallets to hold an xStock within one week. Superstate, Ondo, and Step Finance plan to deliver tokenized equities later this year.

- R3 plans to bring over $10 billion in tokenized assets from Corda, its permissioned distributed ledger technology (DLT) platform, to Solana. R3 supports the issuance and transfer of tokenized assets for regulated financial institutions.

- Maple Finance’s syrupUSDC, a yield-bearing stablecoin, quickly rose to a market cap of $60.1 million. Since its launch in June 2025, 54.2 syrupUSDC tokens have been issued.

- Solana is home to exotic RWAs like Blackrock, Apollo, tokenized real estate, unique physical goods, and collectibles.

Introduction

Real-world assets (RWAs) represent a paradigm shift in decentralized finance, bridging traditional finance (TradFi) with blockchain infrastructure by tokenizing offchain assets such as government bonds, private credit, public equities, real estate, and even physical goods. This transformation offers new levels of liquidity, programmability, and global accessibility, particularly for financial instruments that have historically been illiquid, restricted, or inefficiently distributed. Over the past year, Solana has emerged as a serious contender in this space, establishing itself as a viable platform for institutions and retail users alike to access and interact with RWAs onchain.

Solana’s appeal stems from its high throughput, near-zero transaction costs, and robust developer ecosystem. Technical innovations like the Token-2022 standard and fast block finality enable seamless compliance tooling, yield distribution, and composable DeFi integrations. These traits make Solana uniquely suited for hosting a broad spectrum of RWAs, from tokenized Treasury tokens to onchain equities and tokenized commodities. Its infrastructure is increasingly tailored to the needs of asset issuers, regulators, and users, paving the way for RWA adoption at both institutional scale and community levels.

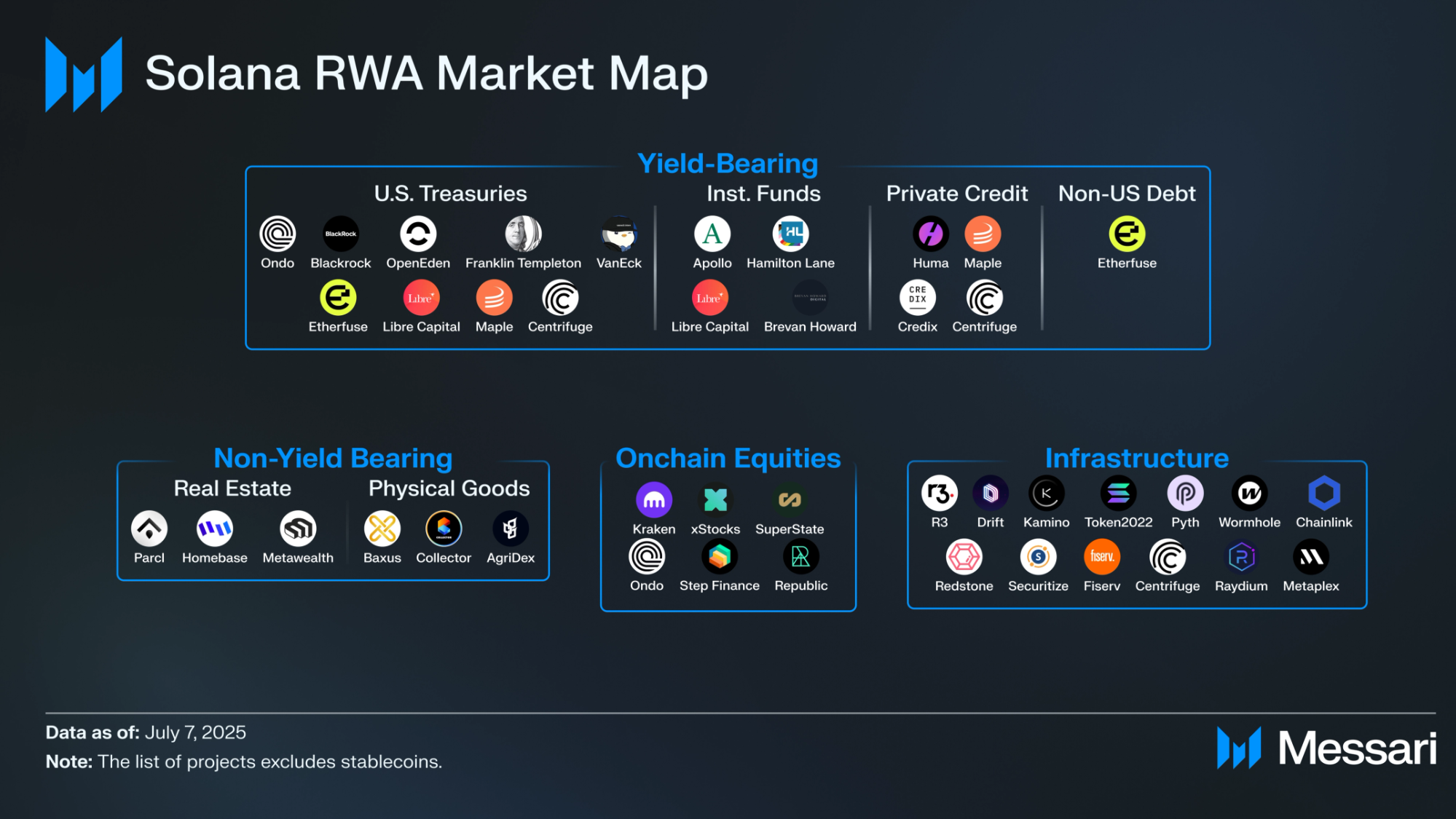

RWAs on Solana exist across four core categories: (1) yield-bearing assets, including tokenized U.S. Treasuries, institutional funds, and private credit protocols like Ondo Finance, Franklin Templeton, and Maple; (2) tokenized public equities, with upcoming launches from Superstate, Kraken, and Ondo Global Markets; (3) non-yielding assets such as tokenized real estate and collectibles from platforms like Parcl and BAXUS; and (4) emerging infrastructure providers like R3 and Securitize that underpin compliance and interoperability. Through this lens, we assess Solana’s trajectory as a rising hub for onchain RWAs and what it means for the future of global capital markets.

Yield-Bearing Assets

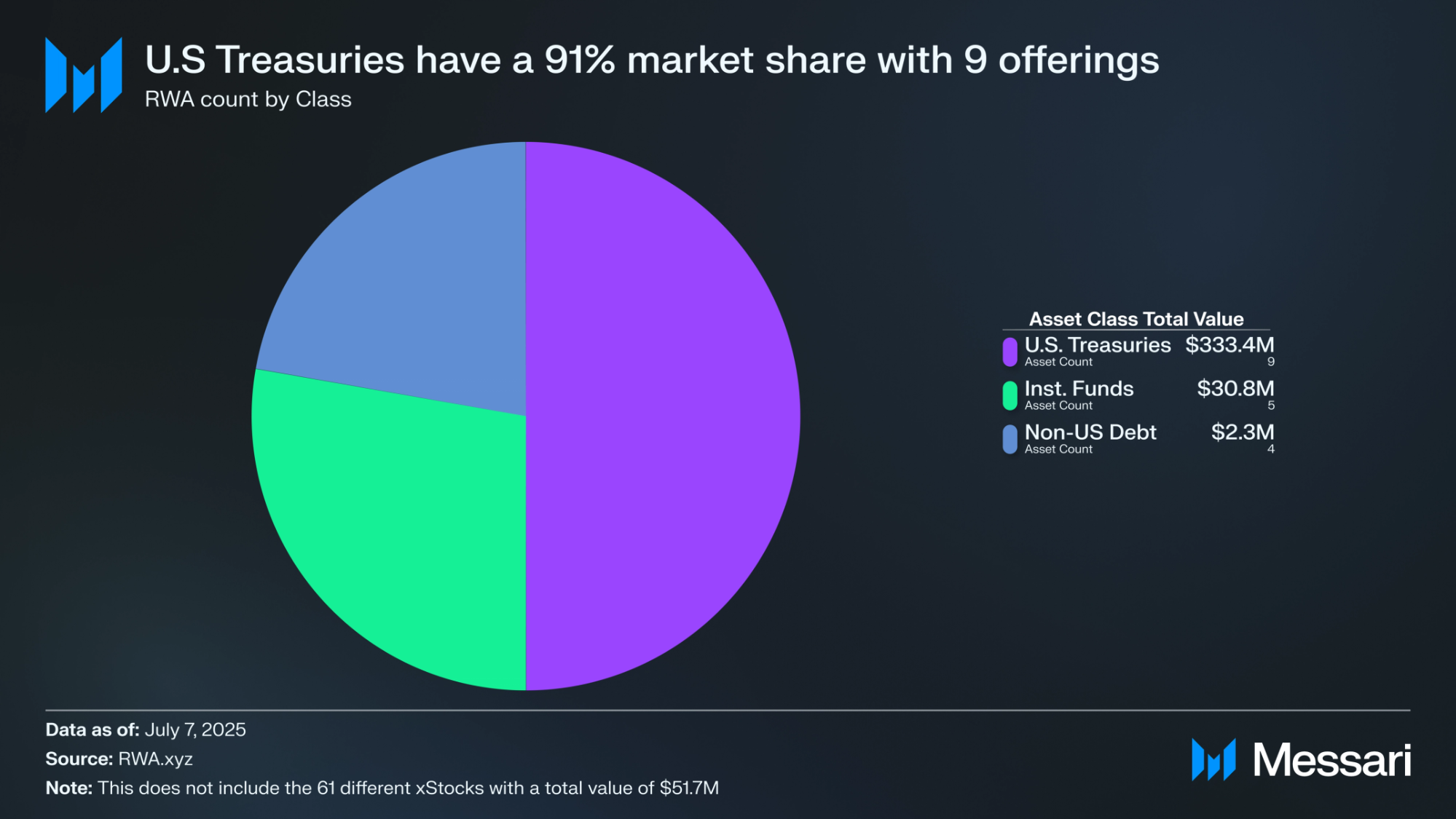

Yield-bearing RWAs are the most significant and fastest-growing segment in Solana’s RWA landscape, capturing the vast majority of non-stablecoin RWA value (USD). These assets, ranging from tokenized U.S. Treasuries to institutional funds and private credit, provide onchain investors with direct exposure to offchain yield streams, often with enhanced composability and 24/7 accessibility compared to their TradFi counterparts.

Disclaimer: All data in this report is as of July 7, 2025.

Tokenized U.S. Treasuries

Tokenized Treasuries offer a digital wrapper for the world’s most liquid and trusted yield instruments and have become a foundational pillar for onchain asset management, stablecoin collateralization, and DAO treasury operations. Solana’s tokenized Treasury market has grown from a small base to encompass a range of products from both native and cross-chain asset issuers.

Ondo Finance – OUSG & USDY (Treasury and Yield Tokens)

OUSG and USDY represent Ondo Finance’s dual approach to tokenized U.S. Treasuries.

- OUSG, introduced in January 2023, is a tokenized fund initially structured,-Liquidity) around BlackRock’s BUIDL Fund. It is primarily intended for accredited investors. In July 2025, OUSG was the second-largest yield-bearing asset by market cap on Solana, with seven holders and a market cap of $79.6 million.

- USDY, launched in August 2023, is a token backed by Treasuries and bank deposits, designed to function as a yield-bearing stablecoin with broad accessibility. USDY appreciates in price as interest accrues. The token is transferable across chains using LayerZero, making it highly composable in DeFi applications. As of July 2025, USDY was the largest yield-bearing RWA by market cap on Solana, with 6,978 holders and a market cap of $175.3 million.

BlackRock – BUIDL (USD Institutional Digital Liquidity Fund)

BUIDL is a tokenized U.S. dollar money market fund developed by BlackRock, holding cash and short-term U.S. Treasuries. Initially launched on Ethereum in March 2024, it expanded to Solana in March 2025, marking one of the first major institutional RWA deployments on the network. The fund has a AAA rating and maintains a stable $1 value while distributing dividends daily. Access is limited to KYC-verified accredited investors leveraging Solana’s 24/7 settlement capabilities and low transaction costs.

BUIDL transforms a traditionally static financial instrument into a highly accessible and interoperable asset. BlackRock’s entry into tokenized RWAs on Solana affirmed the growing credibility and interoperability of public blockchain infrastructure in institutional finance. As of July 2025, BUIDL was the fourth-largest yield-bearing RWA by market cap on Solana with three holders and a market cap of $25.2.3 million.

Franklin Templeton – BENJI (OnChain U.S. Government Money Fund, FOBXX)

BENJI represents shares of Franklin Templeton’s FOBXX money market fund, which invests in U.S. government securities, cash, and repurchase agreements. Originally launched in 2021, BENJI expanded to Solana in February 2025 as part of its multichain rollout, becoming the fund’s eighth supported network. It maintains a stable value of $1 and offers a yield-bearing alternative to traditional stablecoins, with interest accruing daily. BENJI distinguishes itself as one of the first SEC-registered mutual funds available onchain to retail investors, accessible through the Benji mobile app. As of July 2025, BENJI was the fifth-largest yield-bearing RWA by market cap on Solana with two holders and a market cap of $25.9 million.

OpenEden – TBILL (Tokenized T-Bill Vault)

TBILL is a fully collateralized token backed by short-term U.S. Treasury bills, issued through a regulated trust structure. Since its 2023 debut, TBILL has enabled users to mint and redeem tokens 24/7 using stablecoins like USDC, with the token’s price appreciating as interest accrues. OpenEden was among the earliest platforms to introduce a DeFi-accessible Treasury product, aimed at non-U.S. investors.

The product’s low entry barrier, real-time redemption, and high transparency have contributed to its success, with adoption accelerating in Asia and Europe. TBILL is notable for earning a Moody’s “A” rating and is used as yield-bearing collateral in other tokens such as Velo’s USDV stablecoin. As of July 2025, TBILL was the seventh-largest yield-bearing RWA by market cap on Solana with three holders and a market cap of $11.7 million.

VanEck – VBILL (Tokenized U.S. Treasury Fund)

VBILL is a tokenized version of VanEck’s short-term U.S. Treasury strategy, launched on Solana in May 2025 via a partnership with Securitize. Unlike yield-bearing tokens that appreciate in value like OUSG and USDY, VBILL maintains a stable $1 price and distributes yield through daily token dividends. Custody is provided by State Street, and real-time pricing is maintained via Redstone oracles.

VBILL’s standout feature is its atomic redemption via Agora’s AUSD stablecoin, allowing investors to seamlessly move between yield and liquidity by leveraging AUSD’s integrations with Solana DeFi protocols like Kamino. Its structure blends traditional fund management practices with onchain efficiency to serve institutional cash managers. As of July 2025, VBILL was the sixth-largest yield-bearing RWA by market cap on Solana with five holders and a market cap of $13.6 million.

Centrifuge – deRWA & deJTRSY (On-Chain Treasuries)

Centrifuge, known for its early work tokenizing real-world loans on Ethereum and Polkadot, announced its expansion to Solana in May 2025 with the introduction of its deRWA token standard. The first token that will deploy under this framework on Solana is deJTRSY, which represents shares in a $400 million short-term U.S. Treasury fund managed by Anemoy. Unlike conventional security tokens, deRWA assets will be freely transferable and immediately usable within Solana’s DeFi ecosystem, including on platforms such as Raydium, Kamino, and Lulo.

The deJTRSY token will allow Solana users to earn yield from U.S. Treasuries in a fully composable manner, advancing the onchain utility of traditional financial instruments. Centrifuge’s approach removes long standing frictions in RWA token mobility and represents its strategy of bridging institutional-grade funds with high-speed DeFi infrastructure. Beyond Treasuries, Centrifuge powers private credit pools on Solana, enabling asset managers to underwrite real-world loans and offer tokenized tranches to onchain investors. These pools diversify yield sources and enhance credit access for emerging market borrowers.

Tokenized Institutional Funds

Institutional funds on Solana represent a new wave of RWA tokenization, moving beyond simple debt instruments to encompass diversified private credit, real estate, and alternative asset strategies. Not only are these products designed for compliance, transparency, and DeFi composability, they offer more diverse products with higher yield potential than tokenized Treasuries.

Apollo – ACRED (Apollo Diversified Credit Fund)

ACRED is a tokenized version of Apollo Global Management’s diversified private credit fund, created in partnership with Securitize and launched on Solana in May 2025. The token represents interests in a portfolio of corporate loans and other private credit instruments and is issued as a regulated sToken under Securitize’s compliance framework.

ACRED is accessible to accredited investors and integrates with Solana-native DeFi platforms such as Kamino and Drift Institutional. These integrations enable users to borrow stablecoins against their ACRED holdings and implement leveraged strategies, effectively turning a traditionally illiquid asset into composable DeFi collateral. The fund brings institutional-grade credit exposure and capital efficiency to Solana. As of July 2025, ACRED was the third-largest yield-bearing RWA by market cap on Solana with eight holders and a market cap of $26.9 million.

Libre Capital – Tokenized Alternative Funds

Libre Capital is a platform backed by Hamilton Lane and Brevan Howard, offering institutional investors exposure to tokenized alternative assets. In July 2024, Libre launched its Solana integration, becoming the first to introduce private markets credit funds to the network. Among the tokenized funds available are Hamilton Lane’s Senior Credit Opportunities Fund (SCOPE), which targets a yield of 9%, the Brevan Howard Master Fund (BHM), and a short-term USD fund (UMA) managed by the BlackRock ICS US Dollar Liquidity Fund.

Libre serves as a “tokenization gateway” for top-tier fund managers, aggregating a suite of private credit, hedge fund, and liquid alternative strategies. The platform emphasizes permissioned access for accredited investors and aims to unlock secondary trading functionality on Solana to enable real-time liquidity in these traditionally illiquid markets.

Tokenized Private Credit

Solana’s private credit protocols extend the RWA frontier by enabling direct lending to fintechs, small and medium-sized enterprises, and emerging market borrowers, all backed by onchain transparency and risk management.

Maple Finance – syrupUSDC (Yield Stablecoin)

syrupUSDC is Maple Finance’s onchain yield-bearing stablecoin, launched on Solana in June 2025. The token represents deposits into Maple’s credit pools, which underwrite loans to trading firms, market makers, and fintechs. syrupUSDC targets APYs of 6–7% and is positioned as a higher-yielding alternative to traditional yield-bearing stablecoins.

The product is designed for use in DeFi applications and benefits from composability within Solana’s ecosystem, including on DEXs like Orca and lending platforms like Kamino. Maple’s approach combines transparency, rigorous underwriting, and real-time liquidity, turning institutional credit into a stablecoin format that can circulate across the broader DeFi landscape. As of July 2025, over 63.6 million tokens have been issued with a market cap of $70.7 million, with $47 million of that being deposited into Kamino.

Credix Finance – Private Credit Marketplace

Credix Finance operates a Solana-native marketplace for private credit, enabling institutional investors to fund loans originated by fintechs in emerging markets such as Brazil and Colombia. Since its launch in 2023, Credix has facilitated the tokenization of receivables, asset-backed loans, and revenue-sharing agreements. Its pools are often structured with senior and junior tranches to accommodate different risk-return profiles, and include features such as insurance via export credit agencies and bankruptcy-remote trusts. In July 2024, the platform had facilitated financing for hundreds of small and medium-sized enterprises (SMEs) in Brazil. Credix distinguishes itself by focusing on real-world impact and localized deal flow, offering higher yields and diversification opportunities beyond U.S. markets.

Huma Institutional - Private Credit for PayFi

Huma Institutional functions similarly to the private, permissioned lending of Centrifuge, Maple, and Credix. Huma currently supports 12 active lending pools across four different PayFi Protocols, six of which are active on Solana and operated by Arf. Over $97 million in credit has been originated through the Huma platform between these six pools.

Arf is a global liquidity platform offering short-term, USDC-based financing for cross-border payments, eliminating the need for prefunded accounts. Leveraging onchain liquidity, Arf enables fast, low-cost settlements while reducing counterparty risk. In April 2024, Arf merged with Huma to expand its liquidity solutions.

Other Debt-Based Protocols

Etherfuse – Stablebonds (Sovereign Bonds on Solana)

Etherfuse is focused on bringing emerging market sovereign debt and currencies on-chain. Through products like MXNe and Tesouro, the platform tokenizes Mexican and Brazilian government bonds and offers them as stablecoin-like assets on Solana and other networks. MXNe, for instance, is a Mexican peso-denominated stablecoin fully backed by short-term government CETES bonds. This structure enables users to earn yield from sovereign debt while transacting in local currency onchain.

Etherfuse launched its stable bond products in 2024 and has since targeted remittance markets and domestic financial institutions seeking FX-denominated digital instruments. By combining bond-backed stability with DeFi liquidity, Etherfuse introduces a new category of low-volatility, yield-bearing assets that expand RWA access beyond USD-centric instruments.

Onchain Equities

Tokenized equities on Solana represent the next evolution in capital markets, enabling 24/7 trading, fractional ownership, and seamless integration with DeFi protocols. While nascent, this segment is rapidly maturing thanks to advances in compliance, transfer agent technology, and cross-chain infrastructure.

Superstate – Opening Bell (On-Chain Public Equities Platform)

Opening Bell is an equity tokenization platform developed by Superstate, the asset management firm founded by Robert Leshner. Announced in May 2025 in partnership with the, Opening Bell is designed to enable SEC-registered companies to issue and trade equity shares directly on public blockchains like Solana. These shares are recorded via a compliant digital transfer agent and are expected to be fully regulated securities under U.S. law. Also in May 2025, the team co-authored a proposal to the SEC with the Solana Policy Institute and Orca called Project Open, illustrating how securities can be issued and traded on public blockchain infrastructure, which can achieve a more efficient, transparent, and effective way.

The first company scheduled to list on the platform is SOL Strategies (CYFRF), a Solana treasury vehicle worth $280.6 million that also participates in the network by running its own validator. Opening Bell’s onchain trading is anticipated to begin later in 2025. The project aims to reduce the traditional T+2 settlement cycle to near-instant execution and make equities fully programmable and composable in DeFi. This initiative reflects a broader vision of transforming stock exchanges into blockchain-native protocols and making regulated equities available 24/7 to a global investor base.

Backed & Kraken – xStocks (Tokenized Stocks and ETFs)

xStocks is a suite of tokenized U.S. equities and ETFs offered by Backed, a regulated Swiss issuer, in partnership with Kraken. Announced in May 2025 and released on June 30, 2025. The product line launched with over 60 products, ranging from Apple and Tesla to broad index funds, and will be available to non-U.S. clients. These tokens will be issued on Solana as fully collateralized representations of the underlying shares and held in regulated custody. Kraken users will be able to trade the assets on-exchange or withdraw them to be used onchain within DeFi protocols.

xStocks distinguishes itself through a compliance-first structure backed by a European prospectus and its seamless integration with Kraken’s exchange and Solana’s DeFi infrastructure. The platform is designed to democratize access to U.S. equities, particularly for users in regions underserved by traditional brokerage services.

As of July 7, 2025, there are over 45,700 holders of xStocks, with a total market cap of $51.7 million.SPYx, S&P500 xStock, is the largest by value with 9,692 holders and a market cap of $6.8 million. TSLAx, Tesla xStock, is the second largest by value with 9,914 holders and a market cap of $6.2 million.

Ondo – Global Markets Platform

Ondo Global Markets is a forthcoming product suite from Ondo Finance, designed to offer non-U.S. investors direct access to tokenized public equities and ETFs. Rather than issuing synthetic assets or ETFs, Ondo’s platform will function as an onchain brokerage interface where real shares are held in custody and linked to wallet-held onTokens like onTSLA. These tokens will serve as programmable representations of ownership and be used as collateral or transferred between whitelisted users.

Ond’s architecture will allow trade instructions to be executed offchain on traditional exchanges, with instant settlement reflected onchain. Ondo Global Markets is currently under development, with launch targeted for late 2025. Its approach stands out for treating tokens as messaging infrastructure rather than new asset classes, enabling compliance and liquidity without compromising onchain programmability. Once live, it is expected to bring thousands of traditional equity assets into the Solana ecosystem.

Republic - Mirror Tokens (Pre-IPO Equity Exposure)

In June 2025, investment platform Republicannounced Mirror Tokens, a new asset class offering economic exposure to high-value private companies, with the first token, rSpaceX, minted on Solana. These tokens are designed to “mirror” the performance of a private company’s shares in the event of a liquidity event like an IPO or acquisition, without granting direct equity or ownership rights. The rSpaceX token makes pre-IPO exposure accessible to non-accredited investors globally for the first time, with minimums as low as $50 and a purchase cap of $5,000. The initiative leverages Solana’s high-performance infrastructure to democratize access to traditionally illiquid private market assets. Republic plans to expand the Mirror Token program to include other prominent private companies.

Step Finance – Remora Markets (Tokenized Stock Trading)

Remora Markets, acquired by Step Finance in December 2024, plans to allow users to trade fractionalized shares of equities on Solana. Remora will be embedded within Step Finance’s broader portfolio management interface and prioritize user-friendly design, small trade sizes, and minimal fees. All revenue generated from Remora will be funneled into STEP token buybacks, aligning protocol incentives with tokenholders. The platform will operate under regulatory licenses obtained via its acquisition and supports 24/7 trading and instant settlement.

Remora takes a retail-first approach to tokenized equities, positioning itself as an accessible alternative to more institutionally oriented platforms like Opening Bell and xStocks. The platform is still in development and targets a full launch later in 2025.

Non-Yield Bearing Assets

While yield-bearing assets dominate Solana’s RWA TVL, non-yield-bearing products play a critical role in expanding the asset universe and demonstrating the flexibility of Solana’s infrastructure. These include tokenized real estate, unique physical goods, and collectibles.

Tokenized Real Estate

- Parcl: Parcl enables users to invest in the price movements of specific geographic real estate markets, such as those in major U.S. cities, without owning physical property. By tracking price indices (price per square foot) and creating tradeable markets for these metrics, Parcl provides a liquid, accessible, and low-fee way to gain exposure to real estate trends.

- Homebase: Homebase issues tokenized NFTs representing fractional ownership in single-family rental properties in the U.S., with a focus on regulatory compliance (KYC, escrow, lockup). Investors can buy and sell shares directly on the Homebase platform, lowering barriers to entry and increasing market liquidity while maintaining legal enforceability.

- MetaWealth: MetaWealth is a Solana-based investment platform focused on fractionalized real estate ownership across European markets. Since its launch, MetaWealth has facilitated over $36 million in tokenized property investments, listing assets in countries such as Romania, Spain, Greece, and Italy, with a user base of over 50,000 investor accounts and 138 tokenized assets.

Tokenized Physical Goods & Collectibles

- BAXUS: BAXUS operates a peer-to-peer marketplace for fine and rare spirits, where bottles are authenticated, vaulted, and tokenized as NFTs on Solana. Users can trade, store, and insure their collections, with NFTs serving as proof of ownership and a redemption mechanism for the physical asset.

- CollectorCrypt: CollectorCrypt brings real-world collectibles, such as Pokémon trading cards, onto Solana, allowing users to deposit items for authentication, tokenization, and DeFi integration. This model expands the use of NFTs as representations of physical value.

- AgriDex: AgriDex tokenizes agricultural commodities on Solana, enabling the purchase and sale of crops as NFTs that encapsulate critical transaction details. By partnering with agricultural organizations and leveraging DeFi tools, AgriDex aims to bring transparency and efficiency to commodity markets.

RWA Infrastructure

Solana’s RWA ecosystem is constructed by a rapidly evolving set of technical standards, data oracles, compliance tools, and market infrastructure.

R3

R3 is a UK-based financial technology company that provides enterprise-grade distributed ledger solutions for regulated financial institutions. While not a direct issuer or investor in RWAs, R3 functions as a technology enabler. It offers middleware and compliance tooling to support the issuance and transfer of tokenized assets from permissioned environments to performant public networks like Solana.

Its flagship product, Corda, is a permissioned distributed ledger technology (DLT) platform used in capital markets, payments, and central bank digital currency (CBDC) projects. Designed for regulated environments, Corda facilitates direct transactions with privacy and compliance at the forefront. R3’s clients include top-tier financial institutions such as HSBC, Bank of America, and the Bank of Italy. As of June 2025, R3 supports over $10 billion in tokenized assets across asset classes.

Drift Institutional

Drift Institutional was announced in May 2025 by Drift, aimed at helping institutions onboard RWAs to Solana. The offering simplifies the tokenization of traditional assets like credit, real estate, and commodities through DeFi-native tools, enabling leverage and composability for more efficient capital use, automated yield strategies, and transparent risk management

Drift Institutional’s debut came through its partnership with Securitize to onboard Apollo’s $1 billion Diversified Credit Fund (ACRED) to Solana. This integration allows verified institutional investors to deposit sACRED into institutional liquidity pools (ACRED-USDC/ACRED-USDT) and borrow stablecoins against their positions.

Kamino Finance

Kamino Finance is a Solana-based lending and borrowing protocol that provides automated strategies for users to engage in lending, borrowing, and liquidity providing. As a key venue for RWA integration, Kamino allows investors to use tokenized real-world assets as onchain collateral. In a notable use case, investors holding shares of Apollo’s tokenized credit fund (ACRED) can deposit them into Kamino to borrow stablecoins, such as USDC, against their position. This function unlocks liquidity for traditionally illiquid assets and deepens their integration within Solana’s DeFi ecosystem.

Fiserv

In June 2025, payments and financial technology company Fiservannounced a strategic collaboration with Circle to advance stablecoin payment capabilities for its clients. The partnership integrates Circle’s USDC infrastructure with Fiserv’s vast global network, which includes thousands of financial institutions and millions of merchant locations. This will enable Fiserv to leverage the Solana blockchain for high-speed, low-cost USDC payment settlements, connecting traditional commerce and banking systems to a modern internet-native financial layer. The move signals a major step in embedding blockchain-based payments into mainstream financial infrastructure.

Other Infrastructure

- Token Standards: The SPL Token and Token-2022 standards provide the foundation for fungible and non-fungible assets on Solana. Token-2022 introduces extensions tailored for RWAs, such as confidential transfers, interest accumulation, programmable transfer restrictions, and hooks for compliance enforcement.

- Oracles: Pyth Network delivers high-frequency, decentralized price feeds for assets across Solana, supporting everything from real estate indices via Parcl to yield-bearing treasuries. Switchboard and Redstone provide additional oracle options, enhancing data redundancy and reducing manipulation risk.

- Bridges: Wormhole and Chainlink’s CCIP facilitate seamless cross-chain transfer and settlement of RWAs, enabling composability with Ethereum, Polygon, Avalanche, and other ecosystems. Projects like Centrifuge and Backed leverage Wormhole to bring institutional-grade assets into Solana’s DeFi stack.

- Compliance & Identity Solutions: Securitize provides KYC/AML enforcement, investor onboarding, and transfer agent services, ensuring regulatory compliance for tokenized funds and equities.

Closing Summary

Solana’s RWA ecosystem has undergone remarkable expansion, evolving from a handful of experimental projects into a robust, diverse, and institutionally credible market segment. Yield-bearing products, especially tokenized Treasuries and institutional funds, anchor this ecosystem, with composable DeFi integrations and programmable compliance setting Solana apart. The concurrent rise of tokenized equities, real estate derivatives, and physical goods illustrates the network’s flexibility and innovation capacity, supported by cutting-edge infrastructure and a growing roster of institutional partners.

Looking ahead, Solana’s unique combination of speed, composability, and developer-driven innovation positions it as a formidable platform for the next wave of RWA adoption. As new asset classes come online and partnerships deepen, Solana is poised not only to rival Ethereum in institutional RWA markets but to define the standard for programmable, global, and democratized finance in the blockchain era.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by the Solana Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

Disclaimer:

- This article is reprinted from [Messari]. All copyrights belong to the original author [Matthew Nay]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.