The Breakout Battle of “E-Guards”: Can the Ethereum Community Foundation Ignite ETH’s Value Flywheel?

1. Introduction: A breakthrough signal in the sluggish era of ETH?

Since 2024, the price of ETH has significantly lagged behind the performance of BTC and SOL, showing a considerable gap from previous market expectations. Bitcoin has performed strongly during this cycle, while Ethereum faces competition and market contention from emerging Layer 1 networks like Solana and Sui, as well as Layer 2 solutions such as Base and Arbitrum, making it difficult for ETH prices to rise in tandem. On the other hand, the decline in mainnet usage has led to a shrinkage in revenue, which has weakened the burning effect of ETH and further suppressed price performance. Additionally, this is related to the poor performance of Ethereum spot ETFs, low institutional adoption, and reserves. In this market environment where “BTC shines alone while ETH is weak,” many believe that the traditional system can no longer effectively boost and protect the value of Ethereum. There is also dissatisfaction within the Ethereum ecosystem regarding the current situation. Some community members attribute the sluggish prices to strategic missteps and governance issues of the Ethereum Foundation (EF), including “weak inaction, centralized governance, low transparency, organizational bloat, and lack of strategic foresight.” Although the EF announced a strategic restructuring in June 2025, it has not fully eliminated external doubts.

Against this background, Ethereum core developer Zak Cole announced the establishment of the Ethereum Community Foundation (ECF) at the 8th Ethereum Community Conference (EthCC 8) held in Cannes, France in July 2025, and shouted the slogan “ETH reaching $10,000 is not a joke, but a necessity!” He pointed out that ECF will “say what the Ethereum Foundation dares not say, and do what the Ethereum Foundation is unwilling to do,” and clearly stated that ECF’s core mission is to support the Ethereum ecosystem in the form of assets and push ETH to $10,000. This declaration not only reflects the community’s disappointment with past governance methods but also sparked widespread discussion on whether this could leverage the Ethereum market.

This article will focus on the background of the establishment of the Ethereum Community Fund (ECF), analyze the fundamental reasons for the price downturn of ETH during this cycle, conduct an in-depth analysis of the mission and strategy of ECF, and compare the differences and conflicts between ECF and the Ethereum Foundation (EF). It will explore the actual impact of ECF’s establishment on the Ethereum ecosystem and the price of ETH. Finally, in conjunction with market reactions and potential future paths, it will look forward to the development trends of the Ethereum ecosystem.

II. Why is ETH lagging behind? - An analysis of five reasons for the price slump.

Source:https://www.tradingview.com/symbols/ETHBTC/

Since the beginning of this year, the ETH/BTC price ratio has continued to decline, reaching a short-term low of 0.01867 on May 25. According to the latest data on July 10, the current ETH/BTC price ratio is 0.02493, which is a decrease of 52.8% compared to the same period last year. The reasons for Ethereum’s weak performance in this cycle are manifold and can be roughly summarized in the following five points:

1. The Impact of the Ethereum Economic Model and Upgrades

From a technical standpoint, the Dencun upgrade in March 2024 significantly changed Ethereum’s economic model. This upgrade introduced Blob transactions, which greatly reduced Layer-2 fees, leading users to turn to Layer-2 solutions like Polygon and Optimism. These networks dispersed the liquidity and transaction demand from the mainnet, resulting in a sharp decline in Ethereum mainnet transaction fee revenue, with mainnet income plummeting by almost 99%. Additionally, due to the lower fees, less ETH was burned, causing the network to shift from deflationary to inflationary, which reduced value support in the long term. Moreover, mainnet activity also showed a downward trend, with some data indicating that transaction volumes fell to multi-year lows after Dencun, raising concerns in the market about the effectiveness of the upgrade.

The Pectra upgrade plan scheduled for launch in 2025 focuses on improving staking efficiency, contract performance, and scalability. However, so far, this upgrade has not significantly improved market expectations. The negative impacts brought about by the completion of key upgrades (low burn and high supply) are greater than expected, putting pressure on prices.

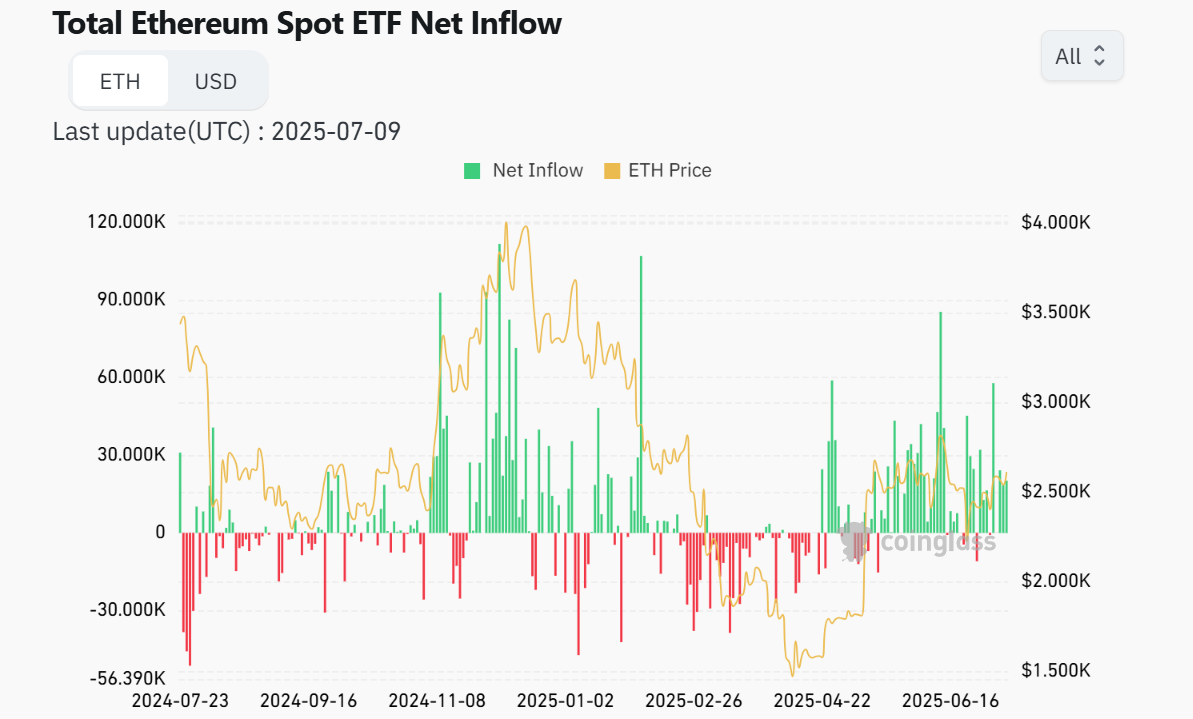

2. Market risk aversion sentiment and spot ETF fund flow

Since the second half of 2024, various macro events have triggered significant market fluctuations, leading to a rise in global risk aversion. Historical data shows that during price declines, Ethereum often experiences a larger drop. Grayscale pointed out that in recent rounds of declines, Ethereum’s average drop was about 1.2 times that of Bitcoin, while this round was nearly 1.8 times.

The Ethereum spot ETF attracted a wave of funds in its early listing phase, but this enthusiasm gradually waned at the beginning of 2025. Bitcoin continues to receive capital favor, while ETH shows a lackluster performance. Although the situation began to improve at the end of April, it still falls short compared to Bitcoin’s performance. As of July 10, 2025, the assets of the U.S. Bitcoin spot ETF are approximately $137.5 billion, while the asset size of the Ethereum spot ETF is only about $11.4 billion, indicating a significant gap in market size compared to Bitcoin and suggesting weak institutional buying.

Source:https://www.coinglass.com/eth-etf

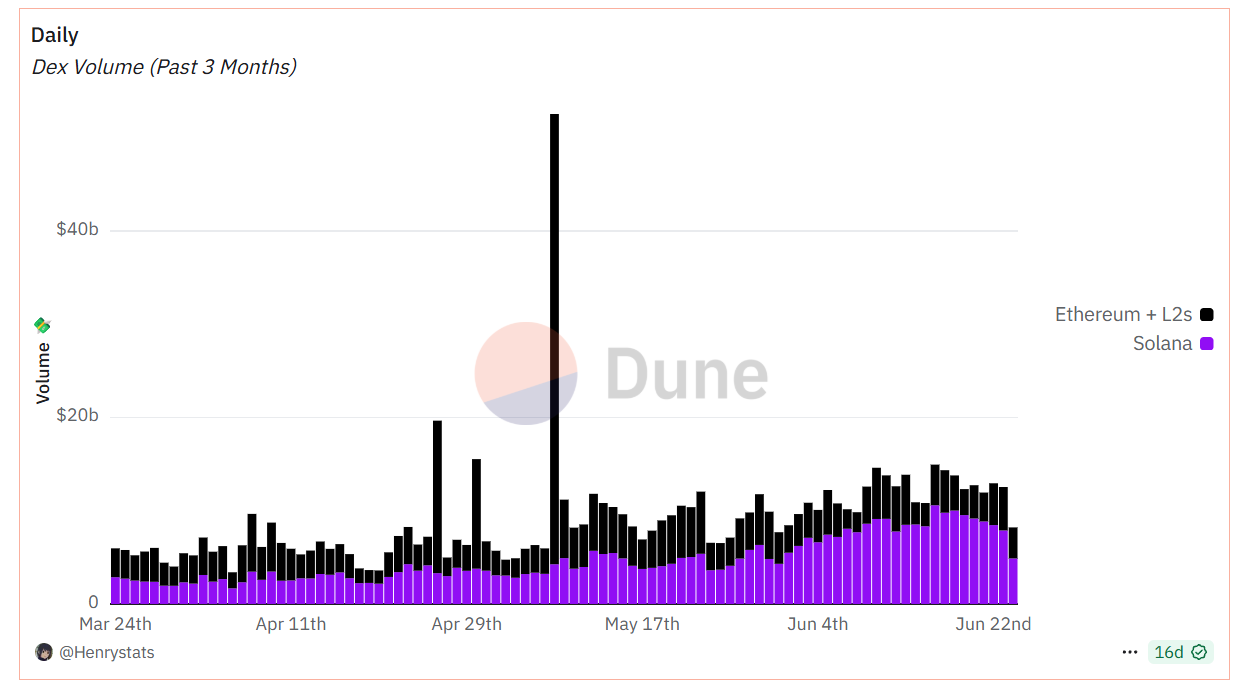

3. Intensified market competition and hotspot diversion

Recent market hotspots have diversified, leading investors to focus on dispersion. On one hand, the United States plans to establish a Bitcoin strategic reserve, and multiple state governments openly support BTC, which has attracted a large amount of investor attention and capital inflow. On the other hand, competitive public chains such as Solana (SOL) and Binance Chain (BNB) have rapidly expanded their ecosystems by leveraging the Meme craze, resulting in significant price increases for related assets. Additionally, other blockchain networks represented by Base Chain, Sui Chain, and Tron Chain have also briefly attracted large amounts of speculative capital, which has somewhat weakened Ethereum’s market attention.

In comparison, Ethereum has recently lacked blockbuster applications or innovative concepts that can trigger widespread market consensus, especially as the pace of innovation in the DeFi sector has significantly slowed down, leading to the marginalization of the Ethereum ecosystem in the competition for hot topics. At the same time, the rapid rise of Ethereum Layer-2 networks (such as Arbitrum, Optimism, etc.) has effectively solved the scalability problem, but has also objectively dispersed ecosystem resources, resulting in reduced trading activity on the mainnet and further leading to a decline in market attention.

Source:https://dune.com/Henrystats/ethereum-vs-solana

4. Institutional demand and interest remain low

Institutional capital remains highly concentrated in Bitcoin, with significantly low demand and attention towards Ethereum in the market. Currently, the strategic reserves of most countries or institutions are still primarily in BTC, with very few incorporating ETH into their long-term asset allocation. Although in July 2025, the New York-listed company Bit Digital announced a complete abandonment of Bitcoin, transferring almost all of its assets into ETH and planning to become one of the largest publicly listed ETH holding companies globally, such actions are still rare in the institutional market. Additionally, some established blockchain companies like BTCS and Sharplink Gaming have also begun to develop Ethereum staking businesses, but these companies are relatively small, and their impact on overall market sentiment is quite limited.

It is evident that the holdings of large institutions, listed companies, and government strategic reserves in ETH are far lower than those in BTC. The obvious preference of institutional capital has led to limited upward valuation potential for Ethereum. In the current market environment, ETH has not yet formed a sufficiently strong degree of institutional recognition and capital attraction.

5. Large Holder Sell-off and Liquidity Uncertainty

Recently, the market has seen a phenomenon where large holding entities represented by Jump Crypto, Paradigm, and Golem Network have reduced their holdings of Ethereum, with these institutions previously holding a combined total of $1.5 billion in ETH. Some of these assets were transferred to exchanges and sold, exacerbating the selling pressure in the market.

At the same time, the changes in the staking reward rate of the Ethereum network and the fluctuations in the number of active validators imply that the circulating supply of ETH is undergoing dynamic adjustments. These uncertainties on the supply side not only increase the volatility of the ETH market but also create additional downward price pressure in the short term, significantly negatively impacting market sentiment.

In summary, the changes in the techno-economic model, macro and leverage risks, competitive landscape, institutional preferences, and liquidity structure—these five factors—have collectively contributed to the recent relative stagnation of Ethereum.

3. The mission of ECF and its comparison with EF

The ECF approaches with a “market mindset,” attempting to enhance the status of ETH as a core asset through financial and policy tools. The Ethereum Community Fund (ECF) claims to “serve ETH holders and do what the EF is unwilling to say or do.” They have set Ethereum’s “North Star” at a price target of $10,000, believing that only when the coin price rises in sync with network security can the long-term value of ETH be guaranteed.

1. The mission and positioning of the Ethereum Community Fund (ECF)

ECF claims to have raised millions of dollars worth of ETH from anonymous ETH holders and community donors, which will fund projects that do not issue their own tokens, are deployed on the Ethereum mainnet, and directly promote ETH burning, based on the three principles of “promoting destruction, no tokens, and immutability.” The strategies disclosed by ECF include:

- Promote high-destruction applications: Fund high-transaction-volume projects on-chain (such as financial derivatives and RWA tokenization) to facilitate ETH destruction by generating large amounts of transaction fees, compressing the circulating supply to boost the coin price.

- Accelerating Institutional Adoption: Providing integrated Ethereum solutions for banks and enterprises, transforming Ethereum into a global settlement layer and introducing traditional financial capital.

- Community Governance Empowerment: Establish the Ethereum Validators Association (EVA) and introduce a token-based voting mechanism, allowing PoS validators to have a greater voice in protocol upgrades and fund allocation.

Transparent Funding: All funding decisions are determined by community token votes, and the flow of funds is 100% open, aiming to avoid the “black box operation” criticized in the past by the EF.

ECF points out that its key areas of focus include infrastructure construction, ETH value enhancement, maximizing ETH burning, extreme transparency, institutional participation, and government cooperation across multiple dimensions. ECF plans to enhance the underlying economy of Ethereum by improving network infrastructure and data availability, engaging with regulatory bodies, and optimizing “blob space” pricing. ECF aims to build an ecological model centered around the appreciation of ETH.

2. The main differences with the Ethereum Foundation (EF)

The significant differences in vision and operation between ECF and the existing Ethereum Foundation (EF) mainly include:

- Goal-oriented: ECF clearly sets raising the price of ETH as its primary goal, viewing the “surge in ETH value” as key to validating network security; whereas EF traditionally emphasizes long-term ecological and technological development (such as protocol upgrades, zero-knowledge research, etc.), and does not consider the price of the coin as a direct target.

- Funding Principles: ECF adheres to the funding conditions of “no tokens, promote destruction, and immutability”: all approved projects must be deployed on the Ethereum mainnet, no new tokens may be issued, and smart contracts cannot be arbitrarily upgraded, ensuring that all economic value directly benefits ETH holders. In contrast, the ecological projects funded by EF (such as Uniswap, ENS, Optimism, etc.) eventually issued their own tokens. ECF criticizes this practice of “Genesis project token issuance” as “economic feudalism,” while EF tends to favor diversified ecological investment without insisting on the “fat protocol” theory.

- Governance Model: ECF emphasizes 100% transparency: all funding proposals and grant allocations are decided through community voting and publicly disclosed. Its goal is to allow token holders to directly oversee the use of funds and criticize the existing EF system for its “centralized decision-making and lack of transparency.” As a traditional non-profit organization, EF’s funding primarily comes from the sale of ETH over the years, with internal decisions driven by a core team and committees, which are often questioned by the community for lacking real-time oversight and decentralization.

- Ideology: ECF publicly claims to represent the “interests of token holders,” and its founding team boasts of following a “capitalism centered around ETH” path; EF, on the other hand, promotes “trustworthy neutrality” and support for public goods, focusing more on protocol neutrality and long-term development. For example, EF is dedicated to promoting community education, consensus layer, and execution layer research, and typically avoids making direct statements about prices; ECF, however, does not hide its intention to treat ETH as an asset class, using price targets to “calibrate” all decisions.

Overall, the emergence of ECF is both a manifestation of dissatisfaction with the traditional foundation model and a discussion within the Ethereum community about balancing “ecological construction” and “asset value.” In the future, whether ECF can fulfill its grand goals, enhance ETH value, and maintain network security; whether EF can reform its governance to address community concerns; these will all impact the development direction of the Ethereum ecosystem. The collision of different ideas and strategies may bring new opportunities for evolution to this decentralized network.

4. Analysis of the Impact of ECF on the Ethereum Network and ETH Prices

The establishment of ECF has multiple potential impacts on the Ethereum network and the price of ETH. If ECF can operate as planned, the potential impact on the Ethereum network could be profound.

1. The impact on the Ethereum network ecosystem

- Infrastructure and Technical Aspects: The public product projects focused on by ECF (such as improving blob data pricing) are expected to enhance the mainnet performance and Layer 2 collaboration, strengthening the overall technical ecosystem of Ethereum.

- On-chain activities and ETH burning: If the ECF successfully promotes high-transaction volume applications such as bringing real-world assets on-chain, it will directly increase Ethereum mainnet transactions and Gas consumption, thereby amplifying the EIP-1559 burning effect and enhancing ETH scarcity.

- Validator Governance: The Ethereum Validator Association (EVA) funded by ECF empowers stakers with a voice in the protocol improvement roadmap, potentially altering the governance landscape of the Ethereum network, giving validators greater influence over fee structures and proposal priorities.

- Relationship with Layer 2: By encouraging the use of Ethereum blob space instead of third-party data networks, the ECF initiative may keep more Layer 2 activities on the Ethereum settlement layer, preventing the mainnet from being marginalized.

- Long-term ecological impact: If the ECF guides more developers to focus on the construction of non-token public utilities, it may reshape the values of the Ethereum DApp ecosystem, encouraging more projects to return to the Ethereum mainnet, using ETH as a value carrier, thereby consolidating Ethereum’s “trustworthy neutrality” position in the competition among public chains.

2. The impact on ETH price

- Supply and Demand Fundamentals: The large-scale destruction of ETH driven by ECF and the increase in actual applications will improve the supply and demand structure of ETH—supply contraction combined with rising demand is expected to create positive support for the coin price.

- Market Confidence and Expectations: ECF has boldly proposed the “ETH $10K” target, establishing a new benchmark for expectations in the minds of investors. This clear price guidance may attract attention both inside and outside the market, and rekindle confidence in ETH.

- Institutional capital inflow: ECF is focused on promoting Ethereum as a global financial settlement layer. If its cooperation with traditional institutions expands smoothly, large institutional capital may enter ETH assets through channels such as corporate chain reform and spot ETFs. This will provide potential new buying power for ETH.

- Risks and Uncertainties: It is important to be wary that overemphasizing price may attract regulatory scrutiny or market skepticism. If ECF fails to deliver performance in the short term, it could disappoint investors. On the other hand, the concentration of ECF’s funding strategy also brings the risk of market influence by a few individuals, which some view as a speculative gimmick. Additionally, ECF’s core initiator Zak Cole has previously participated in multiple projects, but some projects did not achieve ideal price performance after airdrops or trades, potentially leading to trust uncertainties.

Overall, ECF may inject new vitality into the Ethereum network by focusing on public infrastructure, on-chain finance, and governance transparency. If these measures can be successfully implemented, they will help improve the economic efficiency of the network and drive up ETH prices. However, their actual effectiveness still needs to be verified by the subsequent realization of projects and community participation. Even with the support of a foundation like ECF, the key to driving prices upward still depends on whether macroeconomic conditions, regulatory policies, and technological upgrades are in place.

5. Conclusion and Outlook: Community Awakening or Speculative Hype?

The emergence of the Ethereum Community Fund reflects a portion of the group’s dissatisfaction with the current state of Ethereum and has sparked divergent interpretations regarding its future. This could either be a community awakening—a grassroots power fighting against centralization and striving for the maximization of ETH value; or it could simply be another speculative gimmick—a “carefully packaged wealth code.” The bold slogans and radical roadmap released by the ECF precisely capture the community’s desire for price recovery, but whether it can deliver remains to be seen through long-term market testing.

Looking to the future, the direction of the Ethereum network and ETH prices will be influenced by multiple factors. One of the driving forces is the continued inflow of institutional investors, with some listed companies and large institutions starting to invest in ETH as a long-term asset. The Pectra upgrade will further improve data transmission efficiency, paving the way for on-chain applications, especially in AI/Web3 scenarios, which is expected to increase network utilization and lead to more ETH being burned. Additionally, if the on-chain asset issuance and infrastructure investment promoted by the ECF are successfully realized, it will inject new momentum into the Ethereum ecosystem and support the value of ETH.

Regardless of the outcome, the emergence of ECF has already reflected the internal divisions within the Ethereum ecosystem: some people are eager for quick returns and price prosperity, while others focus more on technical advancements and long-term innovation of the protocol. The key for the future lies in whether ECF can promote substantial projects under its framework of “transparency, no tokens, and destruction promotion,” and whether these projects can withstand market tests. If this can be achieved, ECF may become an important variable that drives ETH to regain growth momentum; otherwise, it might just be a high-profile promotion that fades into silence after the excitement.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a service system that integrates “trend judgment + value mining + real-time tracking”. Through deep analysis of cryptocurrency industry trends, multi-dimensional evaluation of potential projects, and 24/7 market volatility monitoring, combined with our weekly strategy live broadcast “Hotcoin Selection” and daily news delivery of “Blockchain Today Headlines”, we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish a cognitive framework and assist professional institutions in capturing alpha returns, jointly seizing value growth opportunities in the Web3 era.

Statement:

- This article is reproduced from [TechFlow] The copyright belongs to the original author [Hotcoin Research] If there are any objections to the reprint, please contact Gate Learn TeamThe team will process it as quickly as possible according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Other language versions of the article are translated by the Gate Learn team, unless otherwise mentioned.GateUnder such circumstances, it is not allowed to copy, disseminate, or plagiarize translated articles.

Share

Content