From grassroots to a market value of 600 billion, Robinhood is entertainment for life

“A good financial person, ‘the Robin Hood’ of finance,” a friend once described Vladmir Tenev.

Later, it was this nickname that became the name of a company that changed the financial industry. However, this is not the beginning of the entire story.

Vladimir Tenev and Baiju Bhatt, the two founders with backgrounds in mathematics and physics from Stanford University, met during a summer research project while they were undergraduates at Stanford.

Neither of them anticipated that they would be deeply bound to a generation of retail investors. They thought they chose retail investors, but in reality, it was the times that chose them.

During his studies at Stanford, Tenev began to question the prospects of mathematical research. He grew tired of the academic life of “spending years delving into a problem, only to end up with nothing” and could not understand his PhD classmates’ obsession with working hard for meager pay. It was this reflection on traditional paths that quietly planted the seeds for his entrepreneurship.

In the autumn of 2011, coinciding with the peak of the “Occupy Wall Street” movement, public dissatisfaction with the financial industry reached a climax. In Zuccotti Park in New York, protesters’ tents were scattered everywhere; even from their office windows in San Francisco, Tenev and Bart could see the aftermath of this scene.

In the same year, they founded a company named Chronos Research in New York to develop high-frequency trading software for financial institutions.

However, they soon realized that traditional brokers, with their high commissions and complicated trading rules, kept ordinary investors out of the financial market. This made them start to think: Can technology that serves institutions also serve retail investors?

At that time, emerging mobile internet companies like Uber, Instagram, and Foursquare were on the rise, and products designed specifically for mobile began to lead the trend. In contrast, in the financial industry, low-cost brokerages like E-Trade still struggled to adapt to mobile devices.

Tenev and Bhatt decided to adapt to the wave of technology and consumption by transforming Chronos into a free stock trading platform aimed at millennials and applied for a brokerage dealer license.

Millennials, the internet, free trading—Robinhood has gathered the three most disruptive elements of this era.

At that time, they did not anticipate that this decision would open up an extraordinary decade for Robinhood.

Hunting the Millennial Generation

Robinhood set its sights on a blue ocean market that was overlooked by traditional brokers at the time - the millennial generation.

A survey conducted by traditional financial services company Charles Schwab in 2018 showed that 31% of investors compare the fees when choosing a brokerage firm. The millennial generation is particularly sensitive to “zero fees,” with more than half of the respondents stating that they would switch to platforms with more competitive pricing because of this.

Commission-free trading emerged against this backdrop. At that time, traditional brokers typically charged $8 to $10 per trade, while Robinhood completely eliminated this fee and imposed no minimum account balance requirement. The model that allowed trading with just one dollar quickly attracted a large number of novice investors, and combined with its simple and intuitive interface, which even had a “game-like” feel, Robinhood successfully increased user trading activity and even cultivated a group of young users who became “addicted to trading.”

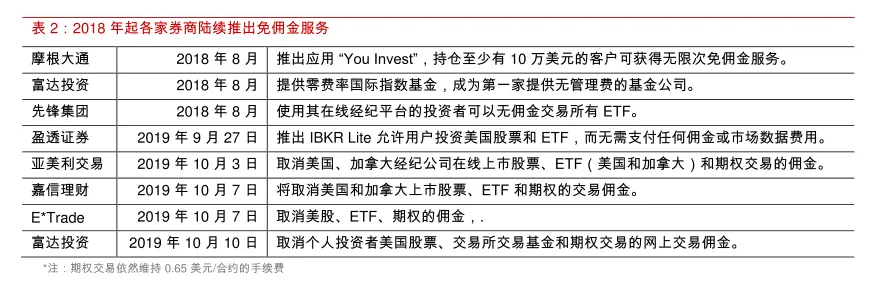

The transformation of the fee model ultimately forced the industry to evolve. In October 2019, Fidelity, Charles Schwab, and E-Trade successively announced that they would reduce trading commissions to zero. Robinhood became the “first” to champion the zero-commission banner.

Source: Orient Securities

Adopting the Material Design style launched by Google in 2014, Robinhood’s gamified interface design even won an Apple Design Award, becoming the first fintech company to receive this honor.

This is part of success, but it is not the most critical part.

In an interview, Tenev described the company’s philosophy by quoting a line from the movie “Wall Street” spoken by the character Gordon Gekko: “The most important commodity that I have is information.”

This sentence reveals the core of Robinhood’s business model - Payment for Order Flow (PFOF).

Like many internet platforms, Robinhood appears to be “free,” but in reality, it comes with a higher cost.

It profits by selling users’ order flow to market makers, but users may not be able to execute trades at the best market prices and believe they are taking advantage of zero-commission trading.

In simple terms, when a user places an order on Robinhood, these orders are not sent directly to the public markets (such as Nasdaq or the NYSE) for execution. Instead, they are first forwarded to market makers that partner with Robinhood (such as Citadel Securities). These market makers will match buy and sell orders at a very small price difference (usually a difference of one-thousandth of a cent) to profit from the spread. In return, the market makers pay Robinhood a “payment for order flow” fee.

In other words, Robinhood’s free trading actually makes money in ways that users “cannot see.”

Despite founder Tenev’s repeated claims that PFOF is not a source of profit for Robinhood, the reality is that in 2020, 75% of Robinhood’s revenue came from trading-related businesses, and by the first quarter of 2021, this number rose to 80.5%. Even though the proportion has slightly decreased in recent years, PFOF remains an important pillar of Robinhood’s revenue.

New York University marketing professor Adam Alter candidly stated in an interview: “For companies like Robinhood, simply having users is not enough. You have to get them to continuously click the ‘buy’ or ‘sell’ buttons, lowering all the barriers people might encounter when making financial decisions.”

Sometimes, this extreme experience of “removing barriers” brings not only convenience but also potential risks.

In March 2020, a 20-year-old American college student named Kearns discovered that his account on Robinhood showed losses of up to $730,000 after trading options—far exceeding his $16,000 principal debt. This young man ultimately chose to take his own life, leaving a note for his family that read: “If you are reading this letter, I am no longer here. Why can a 20-year-old with no income access leverage of nearly $1 million?”

Robinhood has precisely hit the psychology of young retail investors: low barriers to entry, gamification, and social attributes, and has enjoyed the rewards brought by this design. As of March 2025, the average age of Robinhood users remains stable at around 35 years old.

But everything that fate bestows has a price tag, and Robinhood is no exception.

Robin Hood, rob from the poor and give to the rich?

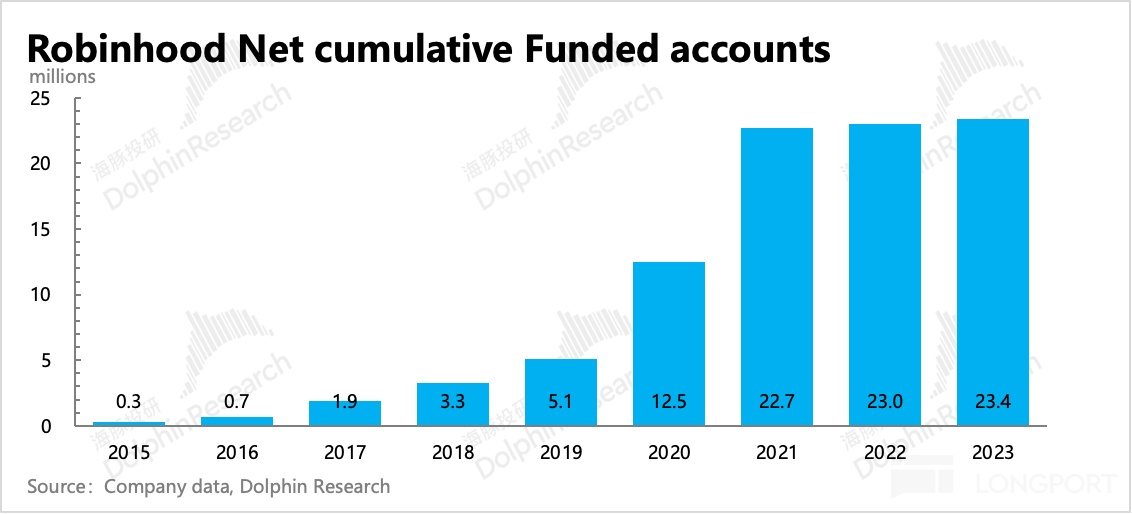

From 2015 to 2021, the number of registered users on the Robinhood platform grew by 75%.

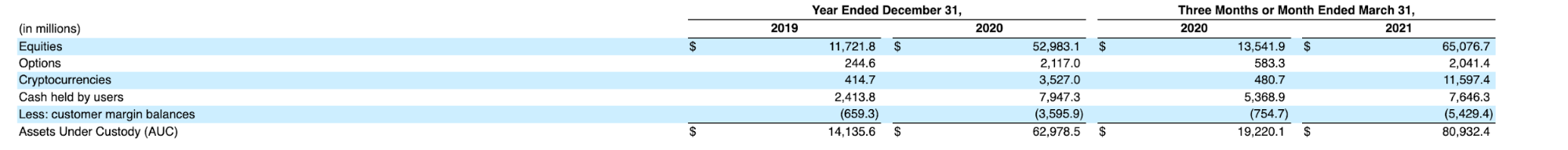

Especially in 2020, with the COVID-19 pandemic, the U.S. government’s stimulus policies, and the nationwide investment craze, the platform’s users and trading volume both skyrocketed, with custodial assets at one point exceeding 135 billion dollars.

The number of users has surged, and disputes have followed closely behind.

At the end of 2020, the Massachusetts securities regulator accused Robinhood of attracting inexperienced investors through “gamification” methods, while failing to provide necessary risk controls during market volatility. Shortly thereafter, the U.S. Securities and Exchange Commission (SEC) also launched an investigation into Robinhood, accusing it of failing to obtain the best execution prices for its users.

Ultimately, Robinhood chose to pay $65 million to settle with the SEC. The SEC bluntly pointed out that even considering the commission-free perks, users overall lost $34.1 million due to price disadvantages. Robinhood denied the allegations, but this controversy is destined to be just the beginning.

What truly drew Robinhood into the whirlpool of public opinion was the GameStop incident in early 2021.

This video game retailer, which carries the childhood memories of a generation of Americans, has fallen into difficulty under the impact of the pandemic and has become a target for institutional investors to short heavily. However, thousands of retail investors are unwilling to watch GameStop be crushed by capital. They gathered on the Reddit forum WallStreetBets, collectively buying through trading platforms like Robinhood, sparking a “retail short squeeze” battle.

GameStop’s stock price skyrocketed from $19.95 on January 12 to $483 on January 28, an increase of over 2300%. A financial frenzy of “grassroots rebellion against Wall Street” shook the traditional financial system.

However, this seemingly retail victory quickly evolved into Robinhood’s “darkest hour.”

The financial infrastructure that year simply could not withstand the sudden surge of trading frenzy. According to the settlement rules at the time, stock trades required T+2 days to complete settlement, and brokers had to set aside risk margin in advance for users’ trades. The skyrocketing trading volume caused the margin that Robinhood needed to pay to clearing houses to rise sharply.

On the morning of January 28, Tenef was awakened by his wife and learned that Robinhood had received a notice from the National Securities Clearing Corporation (NSCC) requiring it to pay up to $3.7 billion in risk margin, which instantly pushed Robinhood’s funding chain to the limit.

He contacted venture capitalists overnight and raised funds everywhere to ensure that the platform was not dragged down by systemic risks. Meanwhile, Robinhood was forced to take extreme measures: limiting the purchase of “meme stocks” like GameStop and AMC, allowing users to only sell.

This decision immediately sparked public outrage.

Millions of retail investors believe that Robinhood has betrayed its commitment to “financial democratization,” criticizing it for succumbing to Wall Street interests. There are even conspiracy theories accusing Robinhood of colluding in secret with Citadel Securities (its largest order flow partner) to manipulate the market to protect hedge fund interests.

Cyberbullying, death threats, and a barrage of negative reviews followed one after another. Robinhood suddenly went from being the “retail investor’s friend” to the target of widespread criticism, and the Tenev family was forced to go into hiding and hire private security.

On January 29, Robinhood announced it had urgently raised $1 billion to sustain operations, followed by several rounds of financing, ultimately accumulating $3.4 billion. Meanwhile, lawmakers, celebrities, and public opinion pursued them relentlessly.

On February 18, Tenev was summoned to attend a hearing before the U.S. Congress, where he insisted in the face of questioning from lawmakers that Robinhood’s decision was due to settlement pressure and had nothing to do with market manipulation.

Nevertheless, the doubts have never subsided. The Financial Industry Regulatory Authority (FINRA) launched a thorough investigation into Robinhood, ultimately issuing the largest single fine in history - $70 million, which includes a $57 million penalty and $13 million in customer compensation.

The GameStop incident became a turning point in the history of Robinhood.

The financial storm has severely damaged Robinhood’s image as a “retail investor protector,” with brand reputation and user trust taking a heavy hit. In no time, Robinhood has become a “survivor in the cracks,” facing dissatisfaction from retail investors and scrutiny from regulators.

However, this event has also prompted U.S. regulators to initiate reforms in the clearing system, pushing to shorten the settlement cycle from T+2 to T+1, bringing long-term impacts to the entire financial industry.

After this crisis, Robinhood pushed forward with its long-prepared IPO.

On July 29, 2021, Robinhood went public on NASDAQ under the ticker “HOOD,” with an offering price set at $38, valuing the company at approximately $32 billion.

However, the IPO did not bring the expected capital feast for Robinhood. On the first day of listing, the stock price opened lower and finally closed at 34.82 dollars, down 8% from the issue price. Although there was a brief rebound due to a retail investor frenzy and institutional buying (such as ARK Invest), the overall trend has been under pressure for a long time.

The divergence between Wall Street and the market is evident - whether to view it as a “financial gateway for the retail era” or to worry about its controversial business model and future regulatory risks.

Robinhood stands at the crossroads of trust and doubt, and has officially entered the reality test of the capital market.

But at that time, few people noticed a signal hidden in the lines of the prospectus – the word “Crypto” was mentioned 318 times in the S-1 filing submitted by Robinhood.

The frequent appearance, seemingly casual, is actually a declaration of a strategic shift.

Crypto is the new narrative that Robinhood has quietly unveiled.

Hit the crypto

As early as 2018, Robinhood quietly ventured into the cryptocurrency business, being one of the first to offer Bitcoin and Ethereum trading services. At that time, this move was more of a supplement to its product line and had not yet become a core strategy.

But the market’s enthusiasm quickly changed everything.

In 2021, The New Yorker described Robinhood this way: “A zero-commission platform that offers both stocks and cryptocurrency trading, aiming to be an enlightened version of Wall Street with the mission of ‘achieving financial democratization for all.’”

The growth of data also confirms the potential of this track:

- In the fourth quarter of 2020, approximately 1.7 million users traded cryptocurrencies on the Robinhood platform, and by the first quarter of 2021, this number soared to 9.5 million, a quarterly increase of over 5 times.

- In the first quarter of 2020, cryptocurrency trading revenue accounted for approximately 4% of the company’s total trading revenue. By the first quarter of 2021, this figure surged to 17%, and in the second quarter, it skyrocketed to 41%.

- When it started in 2019, Robinhood’s cryptocurrency asset size was only $4.15 million. By the end of 2020, this figure skyrocketed to $35.27 million, an increase of over 750%. Entering the first quarter of 2021, the custody size surged to $1.16 billion, a year-on-year growth of over 2,300%.

At this moment, cryptocurrency has transformed from a fringe product into one of Robinhood’s pillars of revenue, clearly positioned as a growth engine. As they stated in the document: “We believe that cryptocurrency trading opens up new avenues for our long-term growth.”

But what exactly happened that led to the explosive growth of Robinhood’s cryptocurrency business in just one or two quarters?

The answer is also found in the S-1 prospectus. Do you remember the crazy Dogecoin from 2021? Robinhood was indeed the driving force behind the Dogecoin craze.

The S-1 filing explicitly states: “For the three months ended June 30, 2021, 62% of cryptocurrency trading revenue came from Dogecoin, compared to 34% in the prior quarter.”

To meet user demand, Robinhood announced plans to launch cryptocurrency deposit and withdrawal features in August 2021, allowing users to freely transfer assets such as Bitcoin, Ethereum, and Dogecoin in and out of their wallets.

Half a year later, at the LA Blockchain Summit, Robinhood officially launched the beta version of the multi-chain supported Robinhood Wallet, which was opened to iOS users in September 2022 and fully launched in 2023.

This move marks the beginning of Robinhood’s official transition from a “centralized brokerage” to a “digital asset platform.”

However, at a crucial stage of Robinhood’s transformation driven by the crypto boom, a man who was quite legendary at the time set his sights on it—Sam Bankman-Fried (SBF).

The then-popular founder and CEO of FTX was known for his aggressive expansion tactics and disruptive ambitions in the financial industry.

In May 2022, SBF quietly acquired approximately 7.6% of Robinhood shares through his holding company Emergent Fidelity Technologies, valued at about $648 million.

After the news was made public, Robinhood’s stock price surged over 30% in after-hours trading.

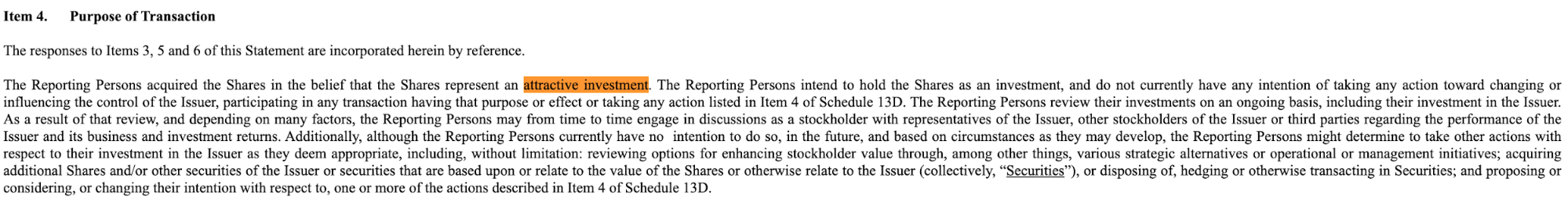

SBF stated in the 13D filing submitted to the U.S. Securities and Exchange Commission (SEC) that he bought into Robinhood because he “considers it an attractive investment” and committed that he currently has no plans to seek control or intervene in management. However, the filing also retains the statement that “future adjustments to his holding intentions may be made based on circumstances,” leaving ample room for maneuver.

In fact, SBF’s move is difficult to simply interpret as a financial investment.

At that time, FTX was actively laying out its compliance strategy in the US market, trying to shed its identity as a “pure crypto exchange” and penetrate into traditional finance and securities business. Robinhood, with its large retail user base and compliance qualifications, was the ideal bridge.

There were rumors in the market that SBF intended to promote a deeper collaboration with Robinhood, even attempting a merger. Although SBF publicly denied this rumor, he has never ruled out the possibility for the future.

However, SBF’s layout did not lead to the ideal “win-win” situation.

At the end of 2022, FTX collapsed dramatically, and SBF was embroiled in allegations of fraud, money laundering, and financial crimes. In January 2023, the U.S. Department of Justice officially seized approximately 56 million shares of Robinhood stock held by SBF through a holding company, which at that time had a market capitalization of about 465 million dollars.

The equity that originally symbolized the “Cryptocurrency Financial Alliance” ultimately became a hot potato of legal evidence.

As of September 1, 2023, Robinhood repurchased this batch of shares from the U.S. Marshals Service (USMS) for $605.7 million, completely mitigating potential holding risks.

It is lamentable that, based on Robinhood’s current market capitalization of 86 billion dollars, the 7.6% stake once held by SBF would be worth approximately 6.5 billion dollars today if it had been maintained, which is more than a tenfold increase from the original cost.

It turns out that this “attractive investment” that SBF believed in is indeed enticing enough.

Take off, stock price

If the GameStop incident was the baptism of Robinhood amidst crises, then 2025 will officially mark the shining moment that belongs to Robinhood.

All of this was foretold long ago.

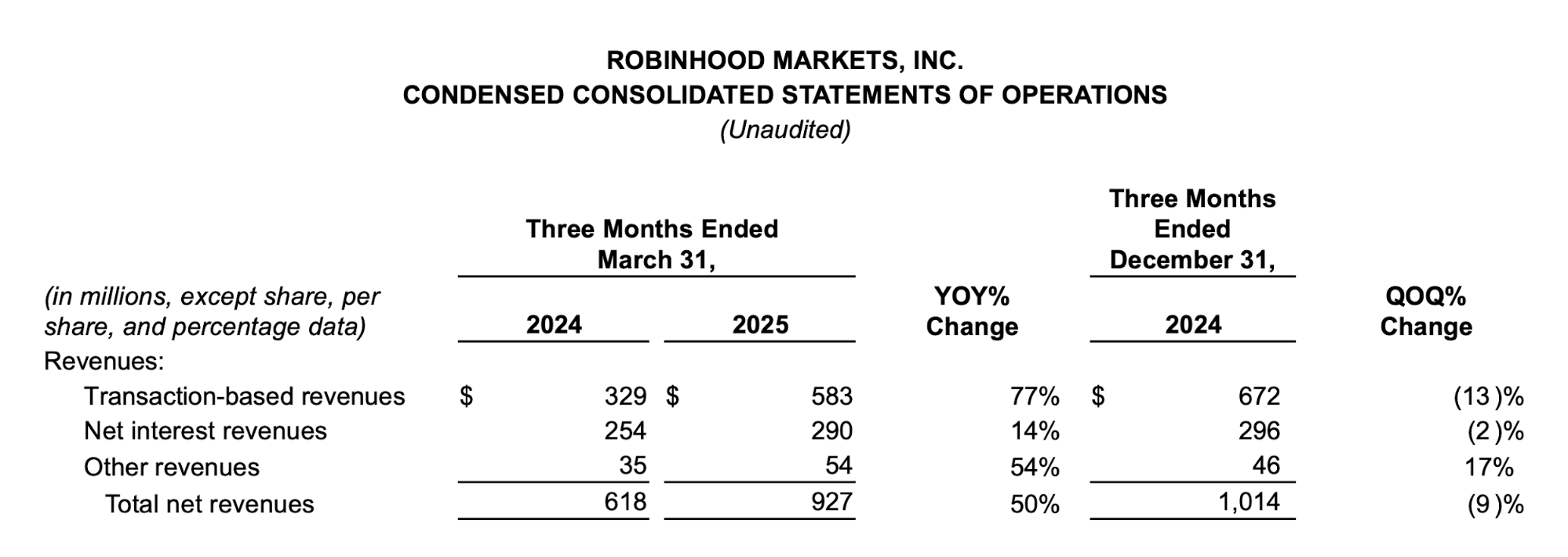

In the fourth quarter of 2024, Robinhood’s key metrics hit new highs:

- Custodied assets, net deposits, gold subscription users, revenue, net profit, adjusted EBITDA, and earnings per share all significantly exceeded expectations;

- Single-quarter revenue exceeded $1.01 billion, net profit reached $916 million, gold subscription users exceeded 2.6 million, adjusted EBITDA reached $613 million…

- The cryptocurrency trading volume surged to $71 billion, with revenue from crypto business increasing by 700% year-on-year, reaching a record high of $358 million in a single quarter.

It is worth noting that in the fourth quarter financial report, Robinhood founder Tenev stated: “We see the huge opportunity in front of us, as we are working to enable anyone, anywhere, to buy, sell, or hold any financial asset and conduct any financial transaction through Robinhood.”

This is probably a small foreshadowing.

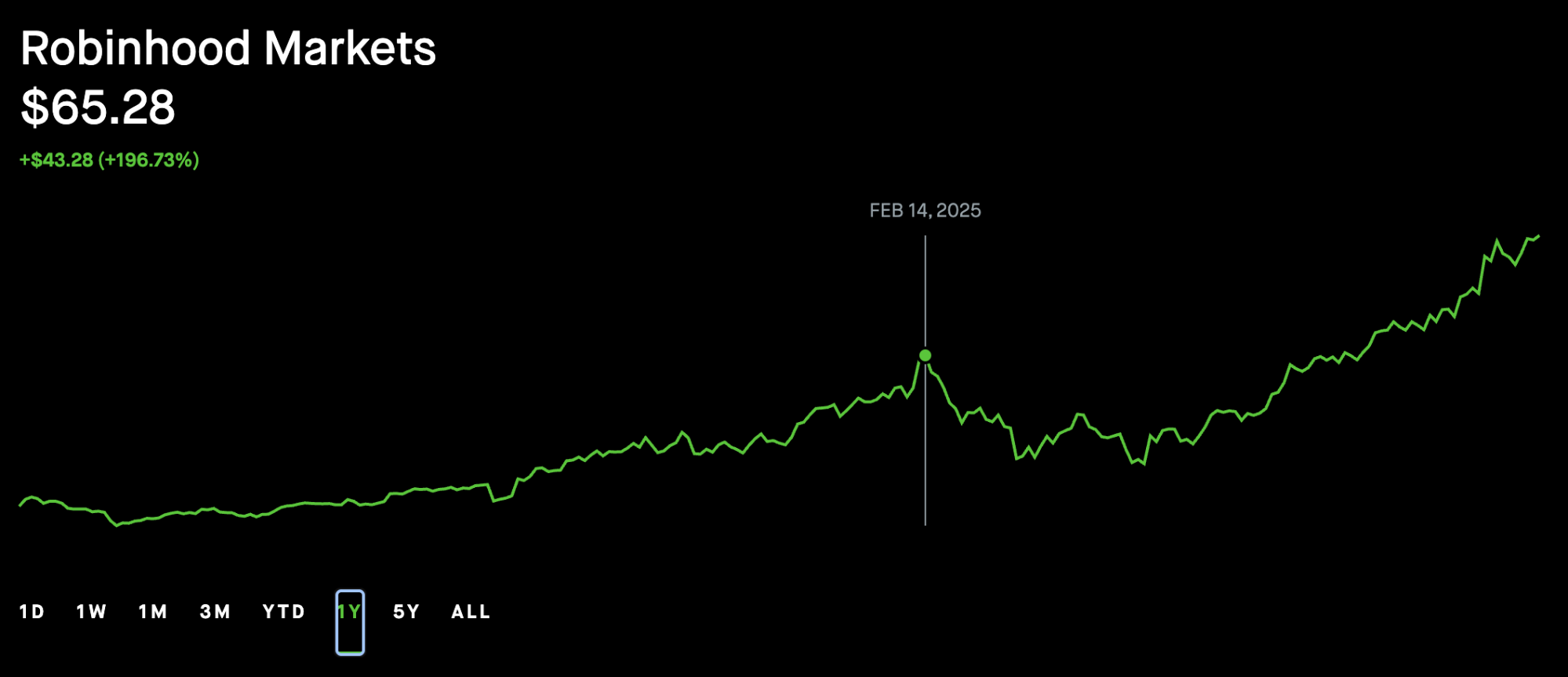

On February 14, 2025, just two days after the earnings report was released, Robinhood’s stock price reached its first peak of 65.28 dollars in 2025.

What really ignited this stock price surge is the resonance between the global financial and cryptocurrency markets.

With Trump’s election and the U.S. policy shifting to be “crypto-friendly”, Robinhood’s regulatory risks are gradually being alleviated.

On February 21, 2025, the U.S. SEC enforcement department officially notified Robinhood Crypto that it had concluded a year-long investigation into its cryptocurrency operations, custody processes, and payment order flows, and decided not to take any enforcement action. This letter not only cleared the policy obstacles for Robinhood’s future expansion in cryptocurrency business but also became an important catalyst for a breakthrough rebound in its stock price.

Immediately after that, Robinhood delivered a heavy blow.

On June 2, 2025, Robinhood officially announced the completion of its acquisition of Bitstamp, one of the world’s oldest cryptocurrency exchanges, for $65 million.

Bitstamp has been renamed “Bitstamp by Robinhood,” fully integrated into the Robinhood Legend and Smart Exchange Routing systems. This strategic acquisition not only provided Robinhood with a ticket to compliant assets and a global market layout but also pushed it from a retail brokerage to compete alongside global cryptocurrency exchanges such as Coinbase and Binance.

The next day, the stock price broke through 70 dollars.

If the acquisition of Bitstamp is an important step for Robinhood to go international, then the subsequent actions announce Robinhood’s significant advance into the Web3 capital markets.

Do you remember the previous announcement by Tenev? “Anyone, anytime, any financial asset, any transaction goes further.”

On June 30, 2025, Robinhood announced its official foray into the blockchain securities field, allowing European users to trade over 200 U.S. stocks and ETFs on the Arbitrum network through blockchain-based tokens, including stocks from well-known companies such as Nvidia, Apple, and Microsoft.

Moreover, Robinhood has also announced the development plan for its self-researched Layer-2 blockchain “Robinhood Chain.”

The market reacted significantly to this, with Robinhood’s stock price surging by 46% within the month, and breaking the $100 mark during intraday trading on July 2, setting a new historical high.

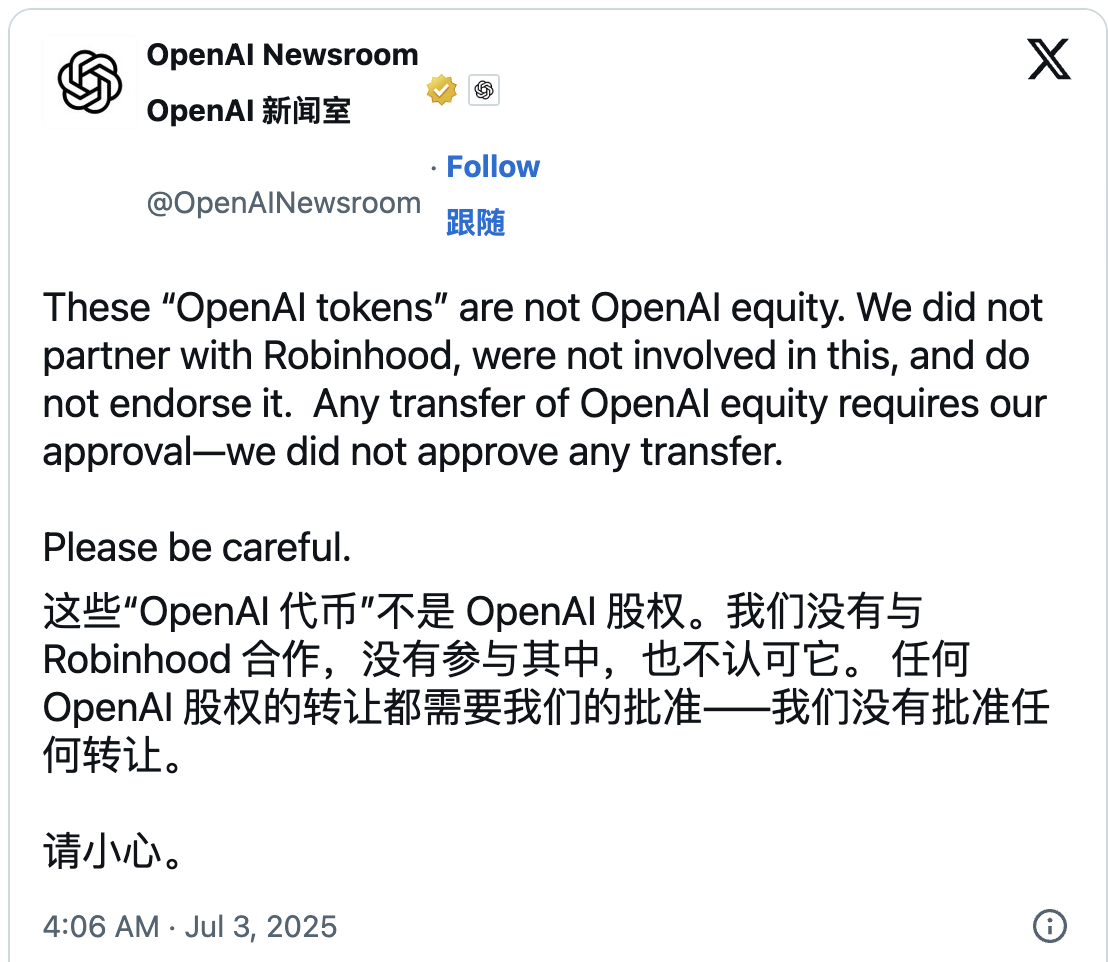

Despite a brief correction in the market following rumors about OpenAI’s equity tokenization being debunked, analysts generally believe that Robinhood has successfully transformed from a “retail brokerage” to a “fintech platform,” and blockchain securities will become its next long-term growth engine.

As of now, Robinhood’s stock price is steadily around $100, with a year-to-date increase of nearly 150%, and its market capitalization has surpassed $88 billion (approximately 630 billion RMB), far exceeding expectations at the time of its IPO.

From grassroots to today, Robinhood, with a market capitalization of 86.7 billion, is no longer what it used to be. From being the “target of criticism” during the GameStop storm in 2021 to becoming a trendsetter in the wave of financial and cryptocurrency integration in 2025, Robinhood has not only undergone extreme tests in the capital market but has also completed its accelerated restructuring in five years.

If it was history that chose Robinhood back then, now Robinhood has finally become the player that can lead history.

Today, Tenev can probably tell his college self who was worried about a career in mathematics: “You spent a few years exploring a specific problem, and at least you didn’t come away empty-handed.”

Statement:

- This article is reprinted from [TechFlow] The copyright belongs to the original author [Yanz, Liam] If you have any objections to the reprint, please contact Gate Learn TeamThe team will process it as soon as possible according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute any investment advice.

- The other language versions of the article are translated by the Gate Learn team, unless otherwise mentioned.GateUnder such circumstances, copying, disseminating, or plagiarizing translated articles is not allowed.